DO YOU NO WHAT IS THE CREDIT CARD LETS CHECK IT

Credit Card

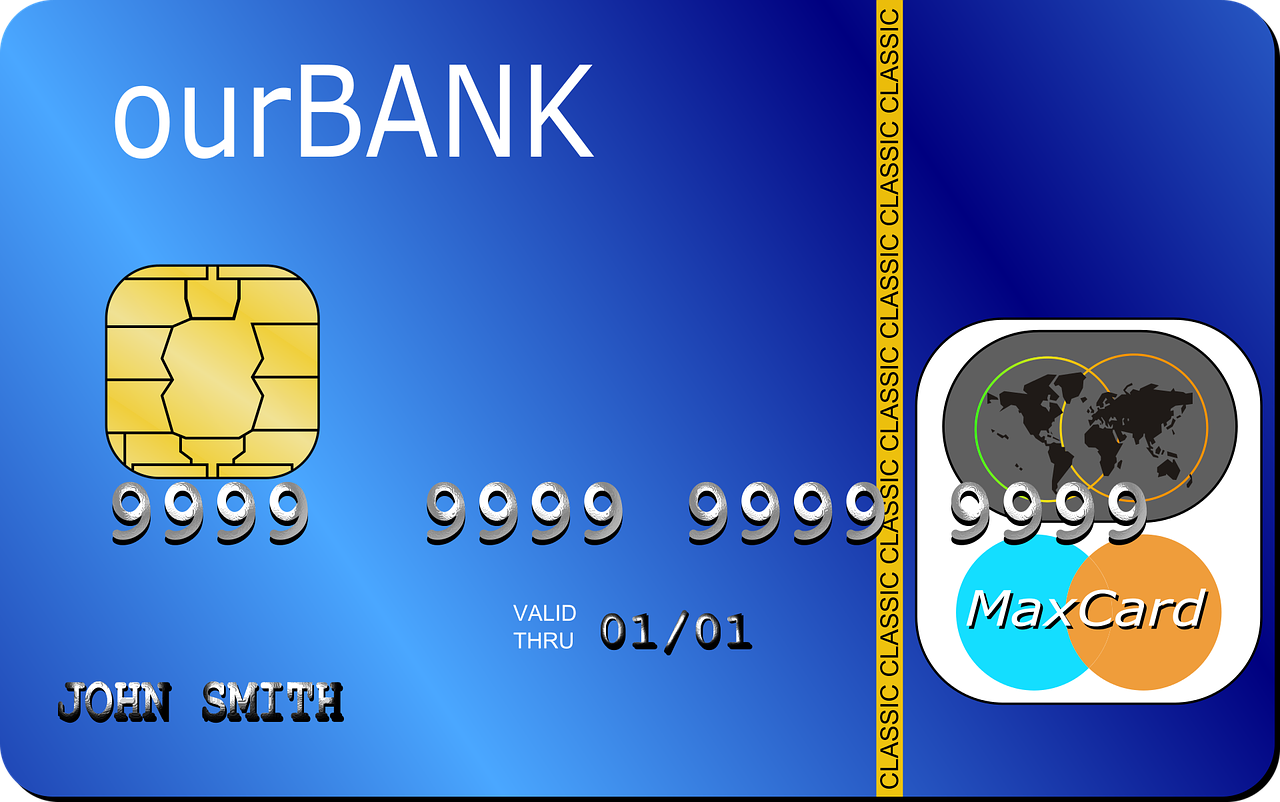

Credit cards and debit cards generally look the same, with 16-digit card numbers, expiration dates, magnetic strips, and EMV chips. Both can make shopping in-store or online easy and convenient, with one important difference. Debit cards allow you to withdraw funds from your bank account. Credit cards allow you to borrow money from the card issuer up to a certain limit to purchase goods or withdraw cash.

Your wallet probably contains at least one credit card and one debit card. The convenience and protection they offer is hard to beat, but they have key differences that can significantly affect your pocketbook. Here’s how to decide which one to use to best suit your spending needs.

Important points

- Credit cards give you access to a bank-issued line of credit, while debit cards deduct money directly from your bank account.

- Credit cards offer better protection to customers against fraud compared to debit cards linked to bank accounts.

What Is a Credit Card?

A credit card is a card issued by a financial institution, typically a bank, and enables the cardholder to borrow funds from that institution. The cardholder agrees to repay the money with interest as per the terms of the institution. Credit cards are issued in the following different categories

- Standard cards extend a line of credit to their users for purchases, balance transfers and/or cash advances and usually have no annual fee.

- Premium cards offer perks like concierge services, airport lounge access, special event access, and more, but they usually have higher annual fees.

- Rewards cards offer customers cash back, travel points or other benefits based on how they spend.

- Balance transfer cards have lower introductory interest rates and fees on balance transfers from another credit card.

- Secured credit cards require an initial cash deposit that the issuer holds as collateral.

- Charge cards have no predetermined spending limits but often don’t allow unpaid balances to carry over from month to month.

Credit card users can avail cash back, discounts, travel points and many other perks unavailable to debit card holders using rewards cards. Rewards can be applied on a flat rate basis or tiered rates. For example, you might have a card that offers unlimited two miles per dollar on purchases and another

That gives three miles per dollar on travel expenses, two miles per dollar on dining and one mile per dollar on everything else. You can then use the earned miles to book future travel arrangements.

Advantages of using a credit card

Credit cards may offer some advantages over debit cards, although they may also have some disadvantages. Take a closer look at the pros and cons of spending with a credit card.

Build a credit history

Credit card usage appears on your credit report. They include a positive history, such as on-time payments and a low credit utilization ratio, as well as negatives, such as late payments or delinquencies. Your credit report information is then used to calculate your credit score. Responsible spenders can increase their score with a spending history and by making on-time payments and keeping their card balances below their card limits.

TIP

Many credit card companies offer free credit score monitoring and tracking as a card benefit, so you can monitor your progress while building credit.

Warranty and Purchase Protection

Some credit cards may also offer additional warranties or insurance on purchased items that go beyond what the retailer or brand offers. For example, whether it provides coverage if an item purchased with a credit card becomes defective after the manufacturer’s warranty has expired.

It’s worth checking with the credit card company to see. Or you may have purchase and price protection built in to help you either replace items that are stolen or lost, or refund the price difference when an item you’ve purchased is sold elsewhere for less.

Fraud Protection

As long as the customer reports the loss or theft in a timely manner, their maximum liability for purchases made after the card goes missing is $50. The Electronic Funds Transfer Act gives debit card customers the same protection against loss or theft—but only if the customer reports the discovery within 48 hours. After 48 hours, the card user’s liability increases to $500; After 60 days, there is no limit.

TIP

In most cases, credit cards offer more fraud protection than debit cards.

Other Credit Card Advantages

The Fair Credit Billing Act allows credit card users to dispute purchases of unauthorized purchases or items damaged or lost during shipping.

If the item was purchased with a debit card, the charge cannot be refunded unless the merchant is willing to do so. What’s more, those whose debit cards have been stolen don’t get their refund until the investigation is complete.

Conversely, the credit cardholder is not responsible for disputed charges; The amount is usually deducted immediately and restored only if the dispute is withdrawn or settled in favor of the merchant. Although some credit and debit card providers offer zero liability protection to their customers, the law is more forgiving for credit cardholders.

If you need to rent a car, many credit cards offer some type of collision discount

Even if you choose to use a debit card, many car rental agencies require customers to provide credit card information as a backup. The only way out for the customer is to allow the rental agency to place a few hundred dollars as a security deposit on the bank account’s debit card.

Do all credit cards charge interest?

All credit cards eventually charge interest on monthly balances, even if they offer you a 0% interest promotion. This interest rate is based on Annual Percentage Rate (APR). To avoid paying interest over the long term, pay off your balance in full every month.

Can Anyone Get a Credit Card?

Most people can apply for and receive credit cards, but if they have bad credit history or no credit, the credit cards they qualify for may not be as helpful. Those with no credit or very bad credit can apply for a secured credit card, where the credit line is secured by a deposit when the card is opened. For more attractive rewards cards, higher credit scores are required.

Disadvantages of using credit cards

The main disadvantages of using credit cards include debt, credit score impact and costs.

Spending can lead to debt

When you shop with a credit card, you’re spending the bank’s money, not your own. This money has to be returned with interest. At the very least, you need to make the minimum payment every month. Accumulating high balances on multiple cards can make it difficult to keep up with monthly payments and put a strain on your budget.

Credit Score Impacts

Paying your bills on time and keeping credit card balances low can help your FICO score. However, credit card abuse can damage your credit history if you make a habit of making late payments, maxing out one or more of your cards, closing old accounts, or repeatedly applying for new credit.

TIP

Set up credit card alerts to notify you about payment due dates and card balances, so you can make payments on time and avoid maxing out your credit limit.

Interest and Fees

Because a credit card is essentially a short-term loan, you have to pay back what you spend with interest. The interest rate and fees that the credit company uses to calculate your annual percentage rate (APR). The higher the card’s APR, the more it will cost you to carry a monthly balance.

Be aware of whether your card charges an annual fee, foreign transaction fee, balance transfer fee, cash advance fee, late payment fee, or returned-payment fee. As a general rule, the better a credit card’s rewards program and the more benefits it offers, the higher the annual fees.

Credit Cards vs. Debit Cards?

- Animals

- Beauty

- birds

- Business

- career

- devices

- Do You Know That facts ?

- drinks

- Education

- Entertainment

- Festivals

- finance

- Flowers

- Food

- FRUITS

- health

- Indian Festivals

- INSECTS

- Insurance

- Jobs

- Just Wild Life

- lawn

- Lifestyle

- places

- Plants

- reasons

- short stories

- SOIL

- sports

- STRATEGIES

- substance

- Technology

- temples

- Travel

- treaditional

- trending news

- Uncategorized

- vehicles

- VIRUSES

- WATER

- workouts

2 thoughts on “WHAT IS THE Credit Card ?”